Investment Strategy

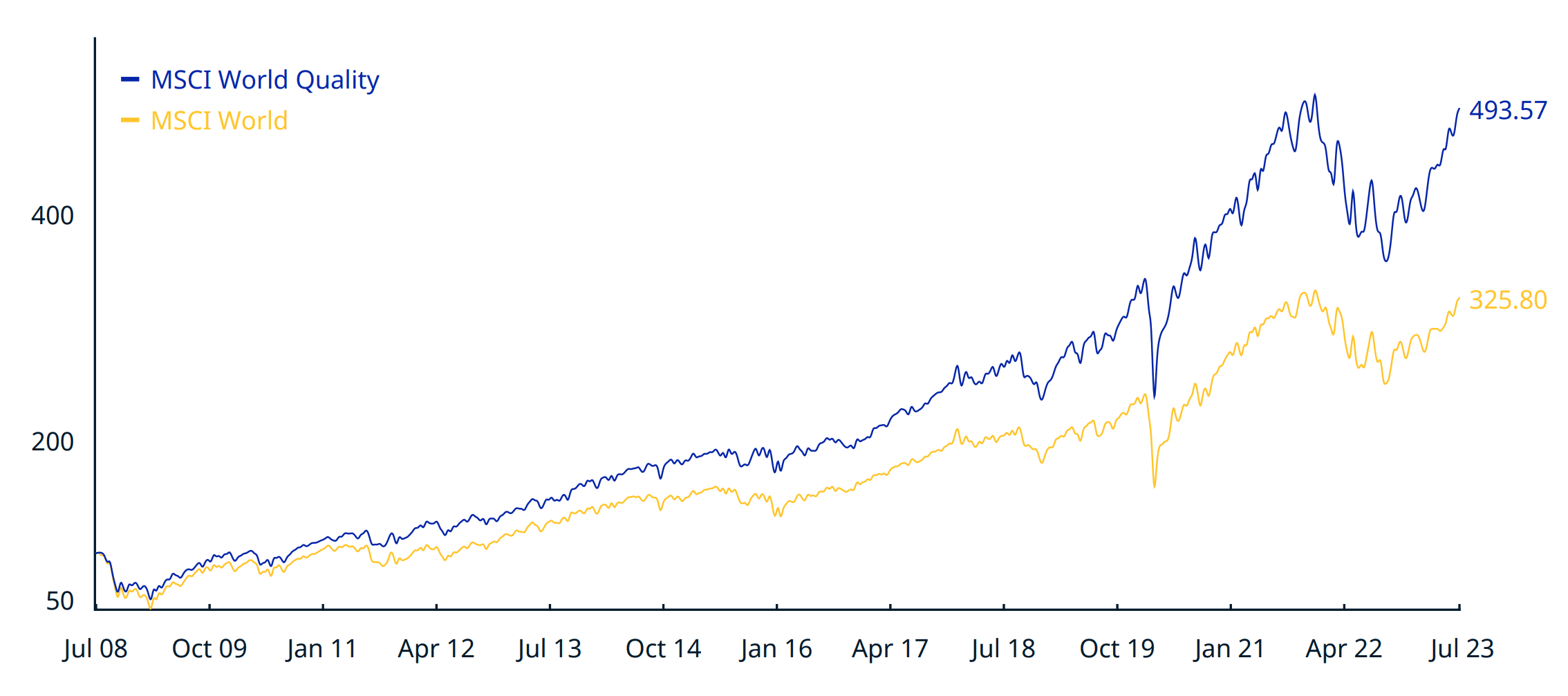

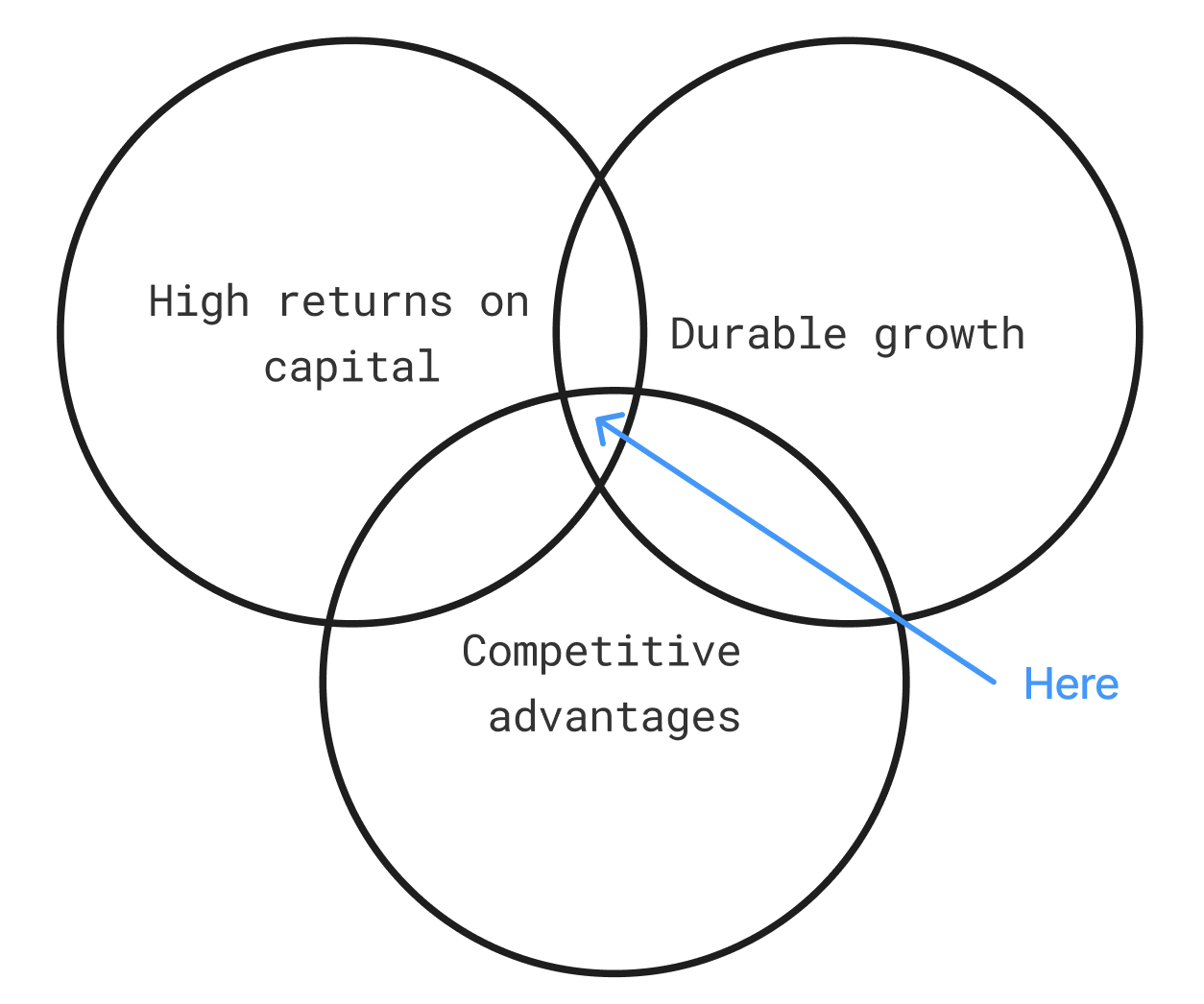

Companies with high return on capital outperform.

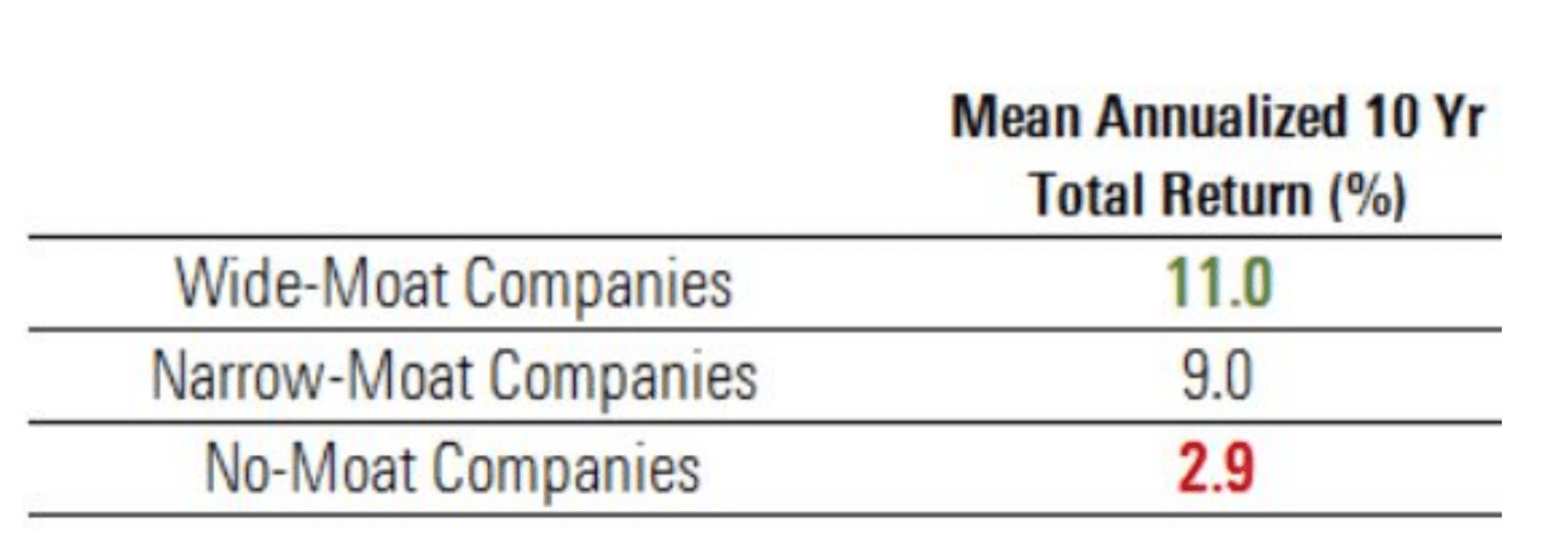

Companies with competitive advantages outperform.

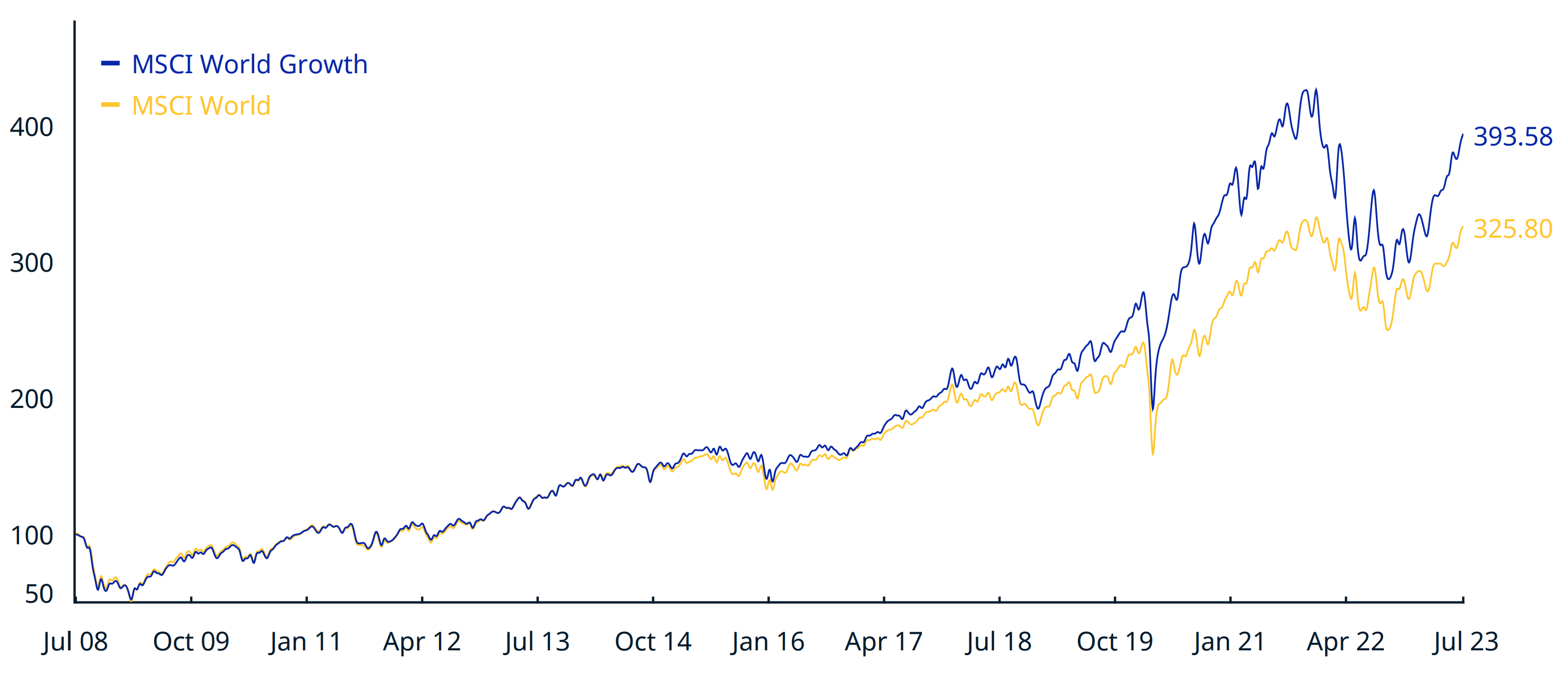

Companies with durable growth outperform.

We invest at the intersection.

We call these companies compounders.

These companies generate high returns on invested capital and have access to attractive opportunities to reinvest earnings. Their business is predictable, stable, and able to grow for many years. We invest in these high quality companies directly and intend to hold for the long term.